Riding Rolls-Royce in Kuwait: The 2008 financial crisis is finally over

Burton Flynn and Ivan Nechunaev

November 2023

Running rounds on arrival

Getting through immigration upon our arrival at the airport in Kuwait resembled a comical play as we were running rounds between the arrival and departure floors from one disinterested bureau to another only to wait in line and be told that we need to get a “circle” stamp on our visa papers, then get that circle stamp and wait in line again and this time be told that we now need a “square” stamp which the previous disinterested officer forgot to graciously grant us, then get that square stamp and this time be told do a fingerprint procedure – which was then canceled by a less disinterested immigration officer midway as it turned out it was not necessary. Finally, with a sigh of relief, we were let in Kuwait.

Outside the visa office at the Kuwait International Airport on our research trip to the country

We go where others don't

We have to admit, it is easy to get spoiled by the seamless immigration processes in a neighboring Dubai where the electronic immigration system lets us in the country by simply scanning our faces – there is no need to get our hands out of our pockets to get in. User experience in Kuwait with the most basic things – for example, paying for a taxi (we tried three different regional credit cards in an official taxi at the airport and all failed) – leaves a lot to be desired. Kuwait is the only democracy with a parliament in the Middle East but it does not make it easier to modernize and diversify the country's oil-centered economy and use the sheer power of its world’s first sovereign wealth fund – the Kuwait Investment Authority which manages a massive $800 billion in assets – as there are chronic political deadlocks in the government, and the parliament gets dissolved nearly every year.

We were told by our contacts in the Middle East that Kuwait used to be what Dubai is today: innovative, progressive, open-minded; though to be fair we also heard that Lebanon's Beirut used to be what Dubai is today and that it was even called the Paris of the Middle East; and we also heard that Buenos Aires was likewise called the Paris of Latin America. There must be a curse related to all these comparisons which haven’t lived up to the expectations and today are united by varying degrees of dysfunctionality rather than by progress.

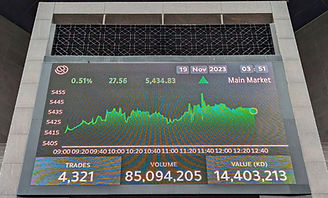

Most everyone in the Middle East – and most emerging markets investors who dare to think about investing in Kuwait – know that the country is having a hard time keeping up with its faster-moving neighbors successfully upgrading their economies: the UAE, Saudi Arabia and Qatar. That is actually good news for us: given that the country’s stock market is considered unattractive from a macro perspective and investors believe there are better places to invest in, Kuwait’s listed companies are overlooked and undiscovered to the liking of bottom-up investors like ourselves. According to us, the times when everyone has fled are exactly the best times to search for misunderstood hidden gems – and recently we found several promising investment opportunities in Kuwait. We met in person with their CEOs on our trip to the country.

We went to Kuwait to meet with high-potential companies trading on the country’s stock exchange

What do Germans, a billion-dollar wastewater plant in Kuwait, and Dubai’s Palm Jumeirah have in common?

We met with the CEO of a $300m investment holding which is backed by a reputable local family and comes with a storied history of long-term success but had a very tough time in the aftermath of the 2008 financial crisis due to a debt and equity imbalance. It took the firm a long 15 years to reduce its debt by 96% and finally clean up all liabilities by the summer of 2023! While many investors in the market assume the business doesn’t exist anymore or is still heavily indebted, the business has started to grow earnings and prosper again in its new debt-free era. According to the CEO, his company – which trades at 5x LTM P/E – has “a lot of hidden value”. It only took us a few simple calculations involving the values of the holding’s three major assets to realize that the CEO was right.

First, this holding company owns 43% in a hotels and resorts subsidiary whose market cap is $600m, which means that the holding’s stake in it is worth $260m. This subsidiary is chiefly focused on developing and operating prime hospitality assets in Dubai and has been hugely benefiting from the ongoing real estate boom in Dubai driven by the wealthy global citizens looking for peace, ease of doing business, and efficient government. According to our contacts on the ground in Dubai, the firm’s prized asset – the Fairmont Hotel on Dubai’s Palm Jumeirah (a prime man-made palm-tree-looking reclaimed land in the sea) – has been consistently having occupancy of over 90% despite increasing room rates. At the same time, the firm’s other assets and projects in Dubai are also delivering exceptional value appreciation and cash flows.

Second, the holding company owns 12% in a financial services business whose market cap is $580m, which means that the holding’s stake in it is worth $70m. This subsidiary has been quickly developing its wealth management business, growing assets under management, and expanding overseas by opening offices in cities such as Dubai, Geneva, and London. Its earnings growth has also been strong in the recent quarters.

Third, the holding company has several years ago formed a joint venture with a German operating partner and entered into a PPP (public-private partnership) with the Kuwait government for a major infrastructure project in Kuwait: a wastewater treatment plant which once completed will be among the largest in the world, with a total project value close to $1bn. Given that it’s a PPP, it has clearly defined project terms, according to which it is mandatory for the plant to undergo an IPO once it is fully operational – and it is likely to happen later this year. The investments made by the company in this project are worth around $85m and are recorded at cost on the company’s books, while the estimated market value of these investments – using a recent comparable PPP IPO – is at least 3x their book value, so around $255m.

As such, when we simply sum up the market values of the holding’s stakes in its three major subsidiaries, they amount to a total of nearly $600m (vs the company’s current market cap of around $300m), implying a 40-50% holding company discount – and this not even taking into account any other business ventures and investments of the holding. In our view, this is a very substantial holding discount which is unwarranted in light of how well the subsidiaries are performing. We believe the upcoming IPO of the holding’s wastewater plant can be the catalyst that will make the company’s “hidden value” much more visible in the market, and can lead to an increase in its overall shareholder value.

Meeting with the CEO of a $300m investment holding

Award for the best restructuring

Our next meeting was with the CEO of another Kuwaiti investment holding, a $350m business with three major verticals: auto leasing, real estate, and private investments. The company’s story was almost identical to the one we heard in the previous meeting: it is also backed by a reputable local family, it also comes with a history of long-term success, and it also had a very tough time in the aftermath of the 2008 financial crisis due to a debt and equity imbalance.

As we were touring the company’s auto leasing hall and assessing whether we could get a better car financing deal than in Dubai, we learned from the CEO that after a major global investment bank had failed to come up with a debt restructuring solution for the company in 2009, the vice chairman owner of the business took the driver seat and himself orchestrated a highly complex and creative restructuring whereby for 15 years he tirelessly worked with several local banks and other parties to turn the business around – and he succeeded. According to the CEO, to fully explain this entire restructuring effort it would take four hours! For his efforts, the vice chairman even won an award for the best restructuring case in the Middle East, but what matters the most is that after a long 15 years of fighting for his company, the business is now debt-free and has started producing strong earnings growth again. As the saying goes, never give up.

Of course, the market has forgotten about the company given its 2008 crisis legacy: many investors think the company went bankrupt, or no longer exists, or is still heavily indebted. And of course, this couldn’t be farther from the truth: earnings are growing very well as all of the holding’s major businesses are delivering a strongly improving performance. To signal its confidence to the shareholders and the market – “we are alive and kicking” – the company has recently reduced the number of shares in circulation.

We like to find overlooked and misunderstood cases like this before the market does – at a time when cheap valuation coincides with a substantial pick-up in earnings growth.

Meeting with the CEO of a $350m investment holding

Investing in Miami and Dubai through Kuwait stock exchange

After navigating the charming Arab streets of Kuwait City, we met with the CEO of a $600m real estate developer and operator. Backed by a respectable local family, this firm gives investors exposure to real estate not only in Kuwait, but also in Dubai (the market which as we mentioned earlier is booming) and in Miami (the market which has also been booming since the pandemic as it attracts New Yorkers and alike seeking lower taxes, nicer weather, and the thrill of the hurricanes). Needless to say, the company’s earnings growth has been very strong on the back of substantial recurring income growth from the existing property portfolio and new projects being launched in various gepgraphies.

The firm prefers to be conservative when it values its high-profile developments (according to the CEO, it is always better to underpromise and then overdeliver) – and we estimate that the business can keep surprising the market to the upside, especially considering that its projects in Kuwait, Dubai, and Miami will keep it fully occupied (pun intended) for at least the next three years, and we have only seen the foundation of future earnings growth from these projects being laid.

Given that the company is one of the very few in Kuwait that provides local investors access to the most trending real estate markets outside of Kuwait, lately the company's shares have been attracting a great deal of retail liquidity – we always appreciate when liquidity is sufficient while valuation is cheap and the stock is still under-understood by the market.

As we were sitting down with the CEO in the company’s office on the 8th floor of its namesake building and enjoying our favorite Arabic coffee – a light-roast type of coffee of a greenish-yellowish color with the smell of added cardamom – we learned that the CEO’s father did one of the first “hostile” takeovers in the region in 1996 by accumulating a 51% stake in this company in a matter of only three days and thus gaining control over it. We thought to ourselves, clearly the CEO-son has learned his bold investment moves that pay off big time from his late father.

Meeting with the CEO of a $600 real estate developer

When in Kuwait, we drive Rolls-Royce and McLaren

Our last meeting on this trip was with the CEO of a $900m premium auto distributor. While Saudis prefer Audis, Kuwaitis like to buy such fine brands as BMW, Land Rover, Rolls-Royce and McLaren from this company. The business prides itself on an exceptionally high net promoter score (NPS) of over 90, the highest score in the region and the testament to the company's top quality of service which surely helps it remain in the pole position in terms of luxury car sales market share in the rich State of Kuwait. We could not pass on the opportunity to test the company’s high-performing vehicles ourselves, and we were surely pleased with the experience.

The company has been riding the major global wave of postponed demand for cars, which we quickly explain as follows: given that global supply chains were broken in the pandemic there was a global shortage of chips, car manufacturers could not produce enough cars without enough chips, car distributors were not getting enough cars, end buyers could not buy enough cars. Then, semiconductor production issues got resolved, car makers started making a lot of cars again, car dealers started getting their car allocations from car makers, and buyers truly unleashed by buying all the cars they could. We had previously seen – through bottom-up stock research – the same trend hugely benefit other car distributors in Malaysia and in the Philippines.

Of note, the company’s sales have lately been rapidly expanding not only in its main luxury car business but also in a much more affordable segment: the firm recently established a manufacturing presence in Egypt to make and sell Chinese car brands – Chinese cars are the new phenomenon taking over the automotive world now, particularly in the affordable electric vehicle (EV) space. The market share of Chinese cars in Egypt has gone from 2% to 20% in just the last few years, and this company we met controls a quarter of all the Chinese car sales in Egypt.

In our meeting, we learned a curious fact: because only 7% of land in Kuwait is used for living purposes while the rest is reserved for oil-related activities, the land in Kuwait is very expensive, comparable to New York or Japan. As such, the land plot on which the company’s car dealership is located could be worth around $150m (the land is owned by the government but businesses buy the right to use the land and can resell that right at exorbitant prices to another private organization if need be).

Having undergone a recent IPO, the company has already noticed one peculiar matter when dealing with the stock market in Kuwait in its newly listed capacity: because the company's absolute share price is “high” (the price to buy one share is $4) many local investors believe the shares are too expensive and thus prefer to buy “cheaper” companies (whose shares trade under $1 per share), regardless of any other – more reasonable – considerations such as the company’s total number of outstanding shares, save for valuation or earnings growth. This example is an absolute classic to explain the degree of inefficiency in the markets we invest in – and inefficiency allows for outsized returns. To resolve this particular inefficiency, we recommended that the company execute a stock split or a bonus share issuance, in order to make sure its share price is “cheap” for the retail investors who, in the absence of foreign investors, typically drive share prices in overlooked and forgotten markets like Kuwait.

Meeting with the CEO of a $900m luxury auto distributor

Sifting through the noise

Kuwait is not typically seen as a go-to destination for emerging markets investors who either ignore the market completely and know nothing about what’s happening on the ground, or say that the country’s macro story is muted, politics always get in the way of reforms, and the oil-rich state never lives up to its full potential. This sounds like very pleasant music to our ears: our fund has often excelled in markets neglected or disliked by others.

Sticking to our mantra of looking for cheap, growing, high-quality businesses in emerging markets, we identified several compelling investment cases in Kuwait: two investment holdings that are coming back to their glory 15 years after the 2008 bust; a real estate developer with exposure to world's hottest real estate markets; and a car distributor benefiting from enormous demand. These businesses are doing very well regardless of the macro noise around them, sticking to their own mantra of “work hard and the results will come, inshallah”.

Until next time, Kuwait! We truly enjoyed our time in your hospitable country.